𝗦𝘁𝗿𝗲𝗻𝗴𝘁𝗵𝗲𝗻𝗶𝗻𝗴 𝗖𝗿𝗲𝗱𝗶𝘁 𝗜𝗻𝗳𝗼𝗿𝗺𝗮𝘁𝗶𝗼𝗻 𝗦𝗵𝗮𝗿𝗶𝗻𝗴 𝗶𝗻 𝗨𝗴𝗮𝗻𝗱𝗮: 𝗖𝗗𝗛 𝗦𝘁𝗮𝗸𝗲𝗵𝗼𝗹𝗱𝗲𝗿 𝗗𝗶𝗮𝗹𝗼𝗴𝘂𝗲

On 26th June 2025, the CREDIT REFERENCE BUREAUS ASSOCIATION OF UGANDA (CRBA) took part in a strategic stakeholder engagement led by Bank of Uganda, in collaboration with IFC – International Finance Corporation and Financial Sector Deepening Uganda (FSD Uganda); and attended by the Uganda Bankers’ Association as well.

The session focused on the planned Central Data Hub (CDH), an innovative platform to streamline the sharing of credit information across Uganda’s financial ecosystem.

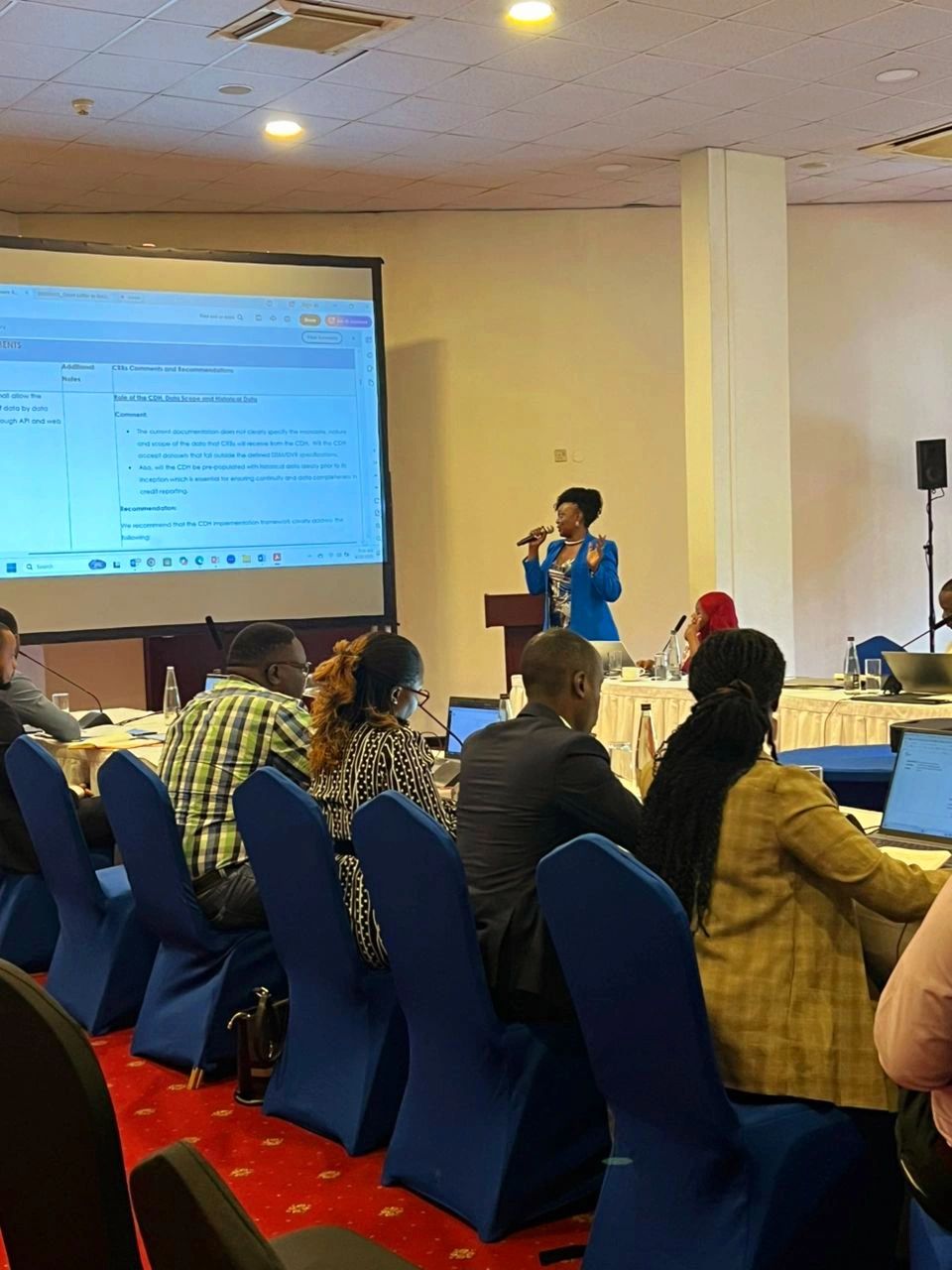

Barbra Among Arinda on behalf of CREDIT REFERENCE BUREAUS ASSOCIATION OF UGANDA (CRBA) as a collective voice for the four CRBs in Uganda, made a detailed presentation in which parties shared feedback, comments and recommendations on a desired system that would best serve the market.

This transformative initiative symbolizes a leap toward a smarter, more inclusive credit ecosystem anchored in collaboration, innovation, and shared purpose; to ensure a secure, inclusive, cost‑efficient, and market‑responsive credit information system that drives financial inclusion, mitigates risk, and benefits consumers and lenders alike.

Metropol Uganda Creditinfo Uganda Armada Credit Bureau gnuGrid CRB